Bitcoin power consumption & environmental impact

As a keen environmentalist I wanted to know the truth. Whilst bitcoin does have undeniable associated CO2 emissions (greatly exaggerated by vested interests) the more obscure environmental upside of Bitcoin is potentially huge ! Money, Finance, Energy & Climate are far more intertwined than most realise. Fixing money may be an essential step to fixing climate.

Bitcoin (live) power consumption = World TeraHash x Bitcoin Average J/THash

(calculating) x (calculating) = (calculating) GW

Bitcoin Mining Annual Power Consumption = Watts x Hours

= (Calculating) TWh

= (NetCO)% of Global electricity consumption

Bitcoin Mining Annual CO₂ Emissions = Power x gCO₂/kWh

(Calculating) x

= (Calculating) MtCO₂

= (NetCOg)% of Global emissions

(Calculating) - (Calculating) Mitigation = Net (NetCO) MtCO₂

= (NetCO)% of Global emissions

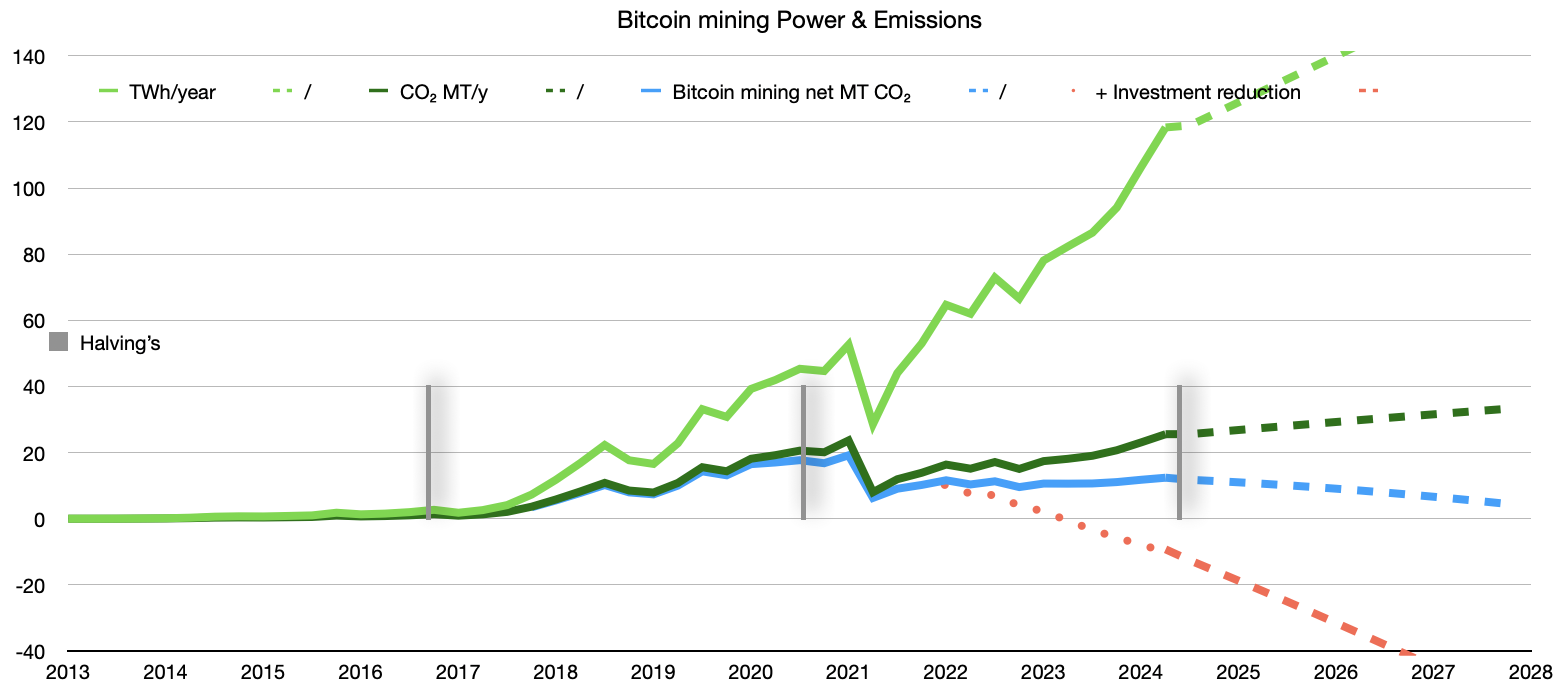

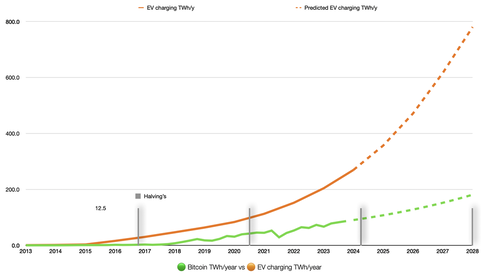

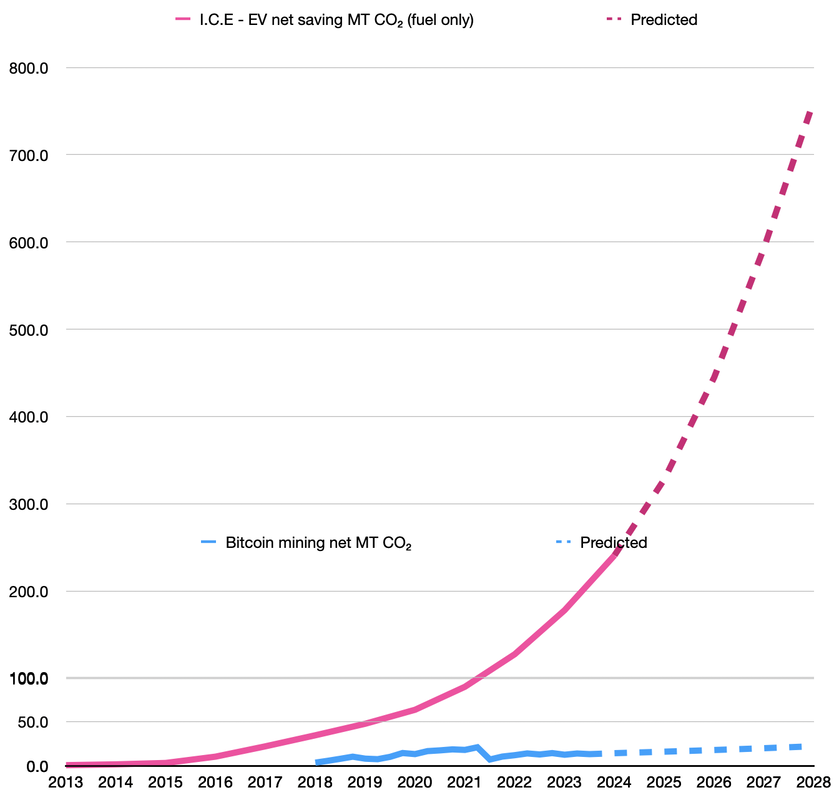

Although Bitcoin's power consumption (Light green line) is climbing, this may be at a peak due to -

Bitcoins net emissions (blue line) have reached a plateau & may even be on the wane due to mitigation such as -

Other mitigating factors are banking sector curtailment (red line) which may already make Bitcoins emissions net negative !

The large drop in emissions during 2021 is due to the China mining ban followed by the subsequent move of much of the hash rate to the US where grid carbon intensity is generally lower. All calculations are Bitcoin BTC ONLY.

- Vast improvements in ASIC efficiency

- Market saturation.

- The recent Halving may also culling off some of the less efficient mining operations

Bitcoins net emissions (blue line) have reached a plateau & may even be on the wane due to mitigation such as -

- Improvements in overall Grid carbon intensity

- Mining with Methane

- Home/ Business heating

- Demand response schemes taking advantage of cheap clean but intermittent renewables.

Other mitigating factors are banking sector curtailment (red line) which may already make Bitcoins emissions net negative !

The large drop in emissions during 2021 is due to the China mining ban followed by the subsequent move of much of the hash rate to the US where grid carbon intensity is generally lower. All calculations are Bitcoin BTC ONLY.

All Currencies have an environmental cost.

- Paper money 💵💷💶 AKA the “Petro Dollar” is backed by Oil, The US military & Banks. The Military is the worlds biggest polluter & Banks require Electricity, Fossil fuel for heating, vehicles, staff, staff travel, helicopters & private jets (for some reason)

- Gold requires mining, consuming vast amounts of fossil fuels, evironmental destruction, vehicles & transportation.

- Bartering has the hassle of converting cows to chickens & remembering who owns what and maybe having to forcefully remind them when they conveniently forget.