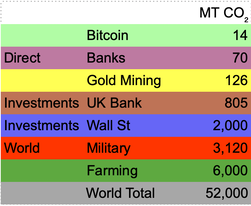

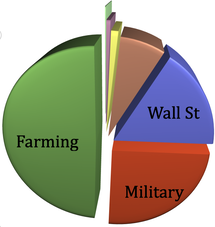

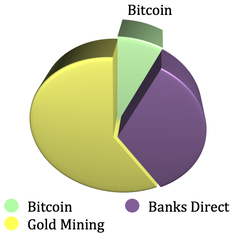

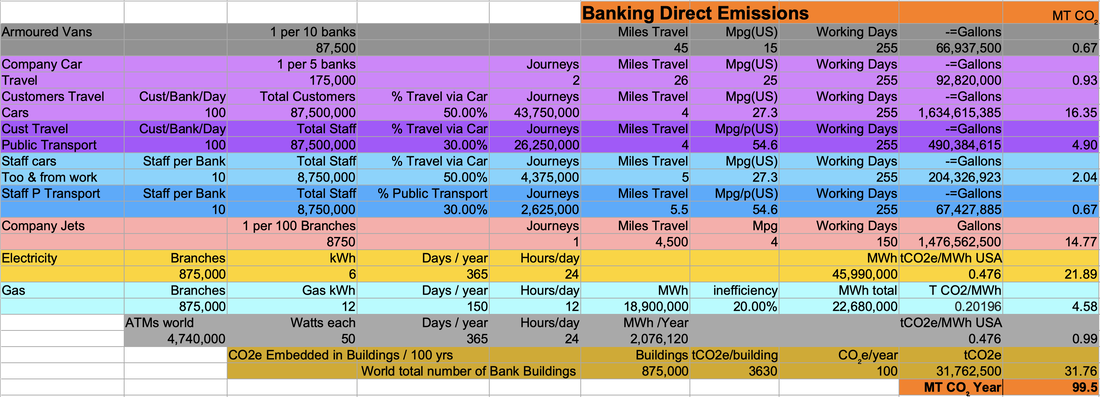

Bitcoin currently has much lower emissions than the direct banking emissions ≈ 99.5 MTCO₂e / year (see guesstimate below), the resulting emissions from investment are an order of magnitude greater.

UK Finance sector. - 805 MTCO₂e.

Wall Street financing - 1968 MTCO₂e

UK Finance sector. - 805 MTCO₂e.

Wall Street financing - 1968 MTCO₂e

Investment Emissions

|

"When the final meltdown occurred in September 2008, Congress passed the Troubled Asset Relief Program (TARP), the (in)famous $700 billion bank bailout of the financial sector. The gains, it turned out, were privatized—the losses were socialized. Wall Street was pro-free market until they were in trouble. 2008 Bank Bailout: Its True Cost, and Who Paid It"

|

Banking emissions

|

Fortunately in the UK 🇬🇧, Europe🇪🇺 & pretty much everywhere oil isn’t gushing out of the ground - low carbon technologies are cheaper. EVs 5x more efficient have 1/6 the fuel costs & Wind & Solar are the cheapest cleanest forms of power. This may not be as obvious in the US 🇺🇸 as printed money subsidies the Fossil Fuels Industry (Bitcoin fixes this).

|

|

Universal basic income for the rich.

Refuse to invest ! Buy Bitcoin !

What if money didn't devalue ? What if it stayed the same, or its purchasing power increased over time.

If inflation is stealing the value of your savings & pensions quite deliberately via money printing, you are effectively being fleeced or forced to invest in anything that will hold its value against inflation, or ideally give a return, usually Oil & Gas. This is great for businesses, but bad for the climate & your finances.

Most Pension's are just a series of investments that you have little control over. Most have no clue as to where their pension is even invested. It's just something deducted from their pay day.

Maybe Bitcoin is the ONLY thing that can combat the Political-Financial Complex.

If inflation is stealing the value of your savings & pensions quite deliberately via money printing, you are effectively being fleeced or forced to invest in anything that will hold its value against inflation, or ideally give a return, usually Oil & Gas. This is great for businesses, but bad for the climate & your finances.

Most Pension's are just a series of investments that you have little control over. Most have no clue as to where their pension is even invested. It's just something deducted from their pay day.

Maybe Bitcoin is the ONLY thing that can combat the Political-Financial Complex.

Money Printing

Money printing = Quantitive easing, debt restructuring, M1 money supply = Insert eye roll 🥱 switch off jargon to hide the fact that they are just printing more money.

What happened in 1933 ?

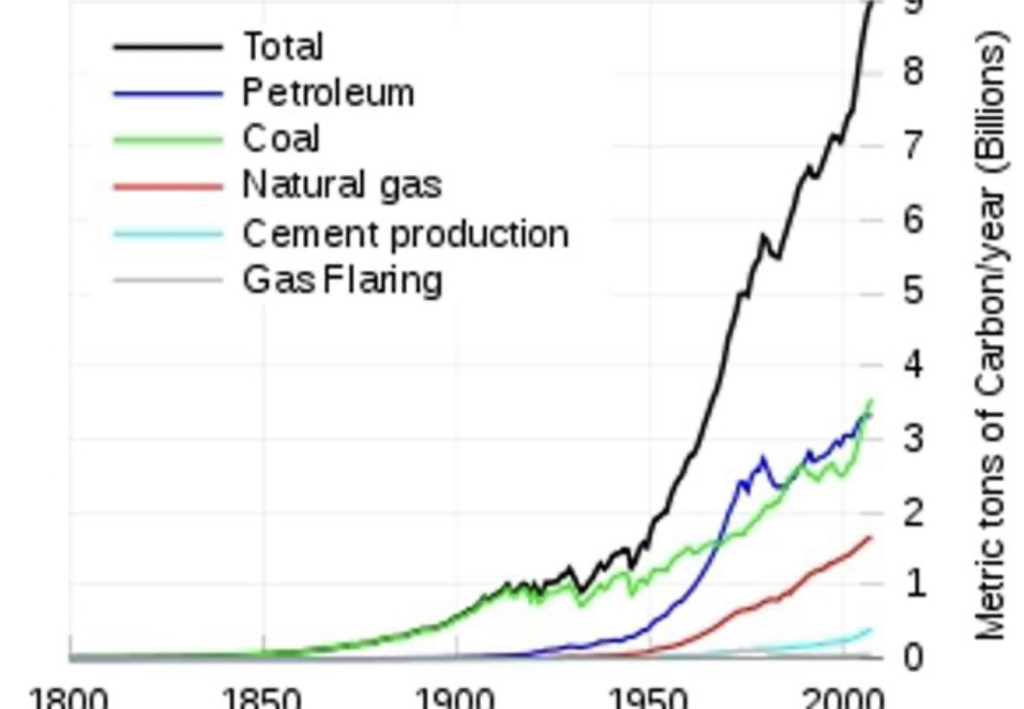

US emissions |

A - The US stopped using hard money - GOLD -

Note the acceleration of US emissions arround the same time. Not all these emissions can be attributed to money printing, but debasing money allows them access to your saved wealth to expand their businesses / empires. |

"The gold standard was abandoned due to its propensity for volatility, as well as the constraints it imposed on governments: by retaining a fixed exchange rate, governments were hamstrung in engaging in expansionary policies to, for example, reduce unemployment during economic recessions." Wikipedia

Conclusions

If Bitcoin could reduce Banking, Gold, banking investments, Military & drive #Degrowth, this could drive the changes on a level required to address the climate emergency !